With the U.S. economy and many others globally being in better shape than they were a few years ago, companies are expanding and selecting those regions where it can grow and prosper. While one company assesses potential regions based on the labor force, ease of regulatory procedures, land availability and utility costs, another company with similar project specifications may focus on logistical speed and reliability, and therefore looks at transportation infrastructures and supply chain linkages to its suppliers and targeted customers. While the site selection criteria can be very specific depending on each company’s unique needs and drivers, these represent some of the more common ones that influence the site location decision.

As the saying goes, change is the only constant

Site selection is a complex process that requires big commitments. It requires evaluating and prioritizing the right combination of factors that offset risks and work to a company’s competitive advantages, not only for its current situation, but also in alignment with its future strategic goals to favor the long-term operating success of the company. The global economy, new competition and emerging technologies drive constant transformations in the way products and services are processed. Thus, companies themselves must evolve and this, in turn, leads to changes in site and location requirements. In the midst of all this variability, there is common consensus among companies that generally points to one factor that tends to be more fixed: the need for talent that comes from a skilled workforce.

Prioritizing workforce skills

The need for trained and experienced workers has increased to the point where today, they’re expected to be lifelong learners adaptable to new skills to stay employable and ensure their own prosperity. This massive shift has grown more apparent since the rebuilding from the last economic downturn. The U.S. and many countries worldwide have seen significant gains in labor and capital productivity. High-tech operational and production processes are replacing what were once manual, labor-intensive tasks. In the ever-shifting landscape where automation is increasing, a skilled workforce is increasingly critical for business growth. This means that more skilled labor is needed to gain additional strategic insights and to operate and maintain technologically advanced equipment. And with constant changes in tech, a business must be knowledgeable and well-acquainted with their technology in order to be effective in their operations. Accordingly, it can be said that the types of skills available in labor markets are more important than the costs or sheer numbers of workers, and more than merely having the latest technology available.

A favorable tax environment is not enough

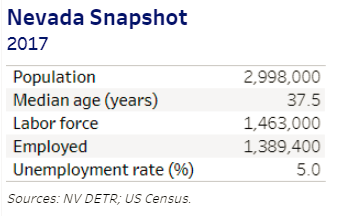

In more recent years, economic development initiatives in Nevada have been successful in attracting and supporting companies across primary industry sectors needed to help diversify the economic base of its communities. Having worked a few years in economic development at the state level, I’ve had the opportunity to work directly with companies looking at Nevada as a potential place to invest capital and create jobs. My dealings in supporting companies in their decision making weren’t nearly as up close as the local and regional-level partners, who were at the forefront of this process. But even in my somewhat limited exposure, it was evident that having a favorable tax and business regulatory environment was not enough. Workforce and labor market considerations were just as important. Companies were very much interested in knowing more about workforce training opportunities and the concentration of workers in various industries and job types.

A priority for Nevada is helping companies recruit and train skilled workers that are productive at competitive wages. Ask any seasoned economic development or workforce specialists here, and they could elaborate in detail about business cases and how having a qualified workforce is often held in higher regard than even the cost of labor. There are numerous site selection surveys out there that support these findings on the national level, but what do the numbers have to say for Nevada?

Nevada site selection survey

One of the goals for the state’s Business Development division a few years back was to streamline the administration of state incentive programs and this included revamping the application form. A survey section was added for applicants representing the company to rate various site selector factors, including accessibility to a qualified workforce and labor costs. It’s been four years since this application has been in place, and with it, a sufficient number of applicant companies to produce a robust enough sample to evaluate.

The survey included the following 12 factors and asked company applicants to “rate the select factors by importance to the company’s business (1 = very low; 5 = very high).”

- Availability of qualified workforce

- Labor costs

- Real estate availability

- Real estate costs

- Utility infrastructure

- Utility costs

- Transportation infrastructure

- Transportation costs

- State and local tax structure

- State and local incentives

- Business permitting & regulatory structure

- Access to higher education resources

This is a short list of factors that is by no means comprehensive, however it captures some of the most typical location decision drivers including variable operating costs, workforce availability, regulatory climate, support infrastructure and real estate attributes.

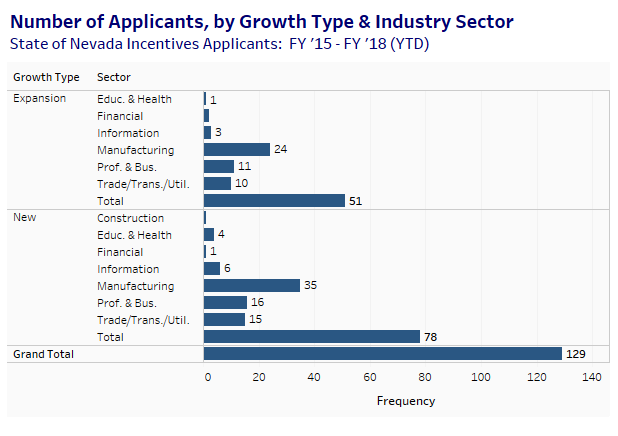

Since FY 2015 to date, over 150 companies applied for company abatements using the latest application form. After omitting those with no responses and were incomplete or incorrectly filled out, the sample for this project totaled 129. Who are these companies in terms of industry sectors and size of job growth planned?

Respondents’ profile

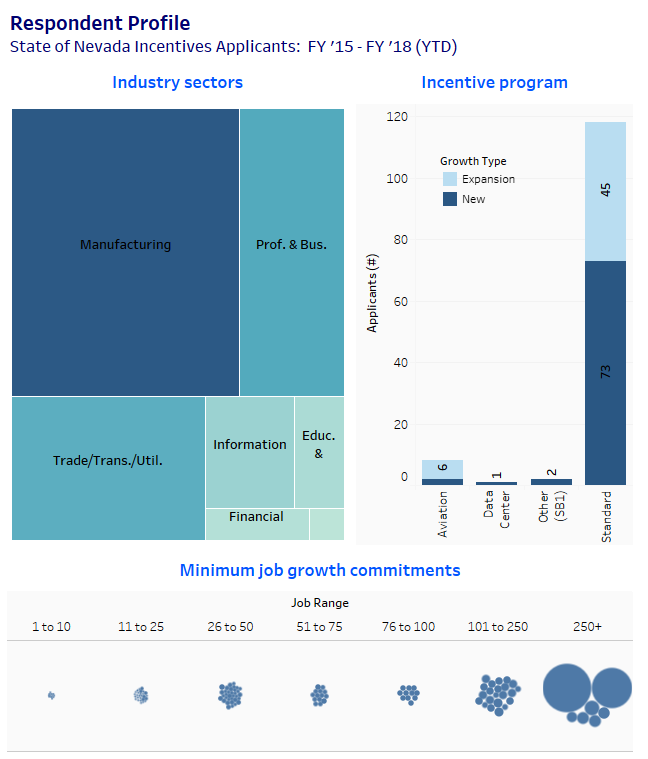

A profile of these companies shows that the “Manufacturing” sector is highly represented, making up nearly half (or 59) of the 129 total respondents. “Professional & Business” and “Trade, Transportation & Utilities” each accounted for another approximately 20 percent of the total. These three are identified in the state’s 2012 economic development plan as being among targeted growth opportunities under the “Mining, Materials, and Manufacturing,” “Business IT Ecosystems,” and “Logistics and Operations” cross-sectors.

By job growth, a quarter of the companies (35) have committed to a minimal job creation in the range of 26 to 50 jobs, followed by 27 companies creating between 11 and 25 jobs. Meanwhile, 29 others are expected to add to over 100 jobs.

It’s important to note that these numbers do not reflect just how big these companies are since job creation has statutory requirements depending on: 1) the type of incentive program, 2) whether it is a new or existing entity in the state, and 3) the county it will locate or expand into along with the rate of unemployment there. Also, some are more conservative (or optimistic) in their projections than others. A vast majority of companies (91 percent) have a two-year timeline to deliver these jobs under the state’s Standard incentives program. The remaining nine percent are those who have applied for the Data Center or Aviation programs, or those authorized to receive incentives under a special session of the Nevada Legislature-all of which require different timelines.

Site selection factor rating results

An interactive dashboard that summarizes the results is available via this link.

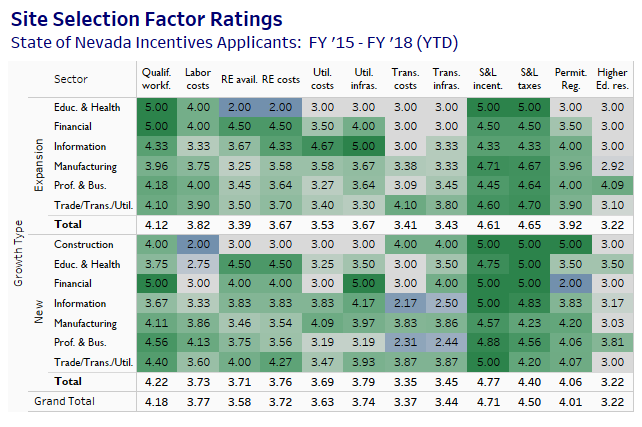

For the overall results, the average ratings for these 12 factors skew upwards, shown by the predominantly green shading. Each factor translates into either lower operating costs, operational productivity, accessibility or lower barriers to entrance - all considered relevant on some level for any business. As such, it is expected to mostly average out of 3 (i.e., neutral in importance) or above. Take a look at the last row - the grand total - and indeed all factors average out to range between 3.22 (“Access to higher education resources”) and 4.71 (“State and local tax incentives”). Also, two of the site selection factors stand out as being very high in importance: “State and local incentives” is the highest, followed closely by the “State and local tax structure.”

It’s a given that for any company that jumps through the hoops in order to apply and qualify for incentive approval, the incentives are inherently significant to the company. Some make the case that if not for them, they would choose to locate in another state that offers more competitive advantages and incentives. The benefits offered by Nevada’s incentive programs are primarily in the form of tax abatements. Abatements are reductions in the rates companies would pay for the sales tax on capital equipment purchases, payroll taxes, taxes on personal property and occasionally for real property taxes. Basically, they remove some of the tax burden for a period of time to assist the company in ramping up operations.

It is very common for states and its regions to compete for the kinds of companies it needs to attract, and for those companies to be rewarded for investing capital and creating high-paying jobs. However, it’s only a matter of time until the fiscal impacts of the incentive are no longer considered a benefit to the public and the ROI of a business is no longer propped up by that incentive. The incentives package will eventually expire and ideally, by then, the company will operate successfully without the subsidies. As such, companies and their site selectors tend to view states that have track records in providing business-friendly tax structures and regulatory environments in high favor.

State and local level incentives and tax structure factors aside, it’s apparent in the survey results that the most important factor is the “Availability of a qualified workforce.” It’s essential for communities to have a talented, sustainable pool of workers to meet the needs of its growing companies. The issue of workforce development is an essential element of any effective economic development strategic plan. Certainly, what a “qualified” workforce means is in the eye of the beholder, but the skillsets, experience, education and training workers possess in a region can define their qualifications.

By the time a company fills out an incentives application in Nevada, it is considered fairly far along the site selection process, and for many, the ensuing approval of the incentives is the final step before giving the go-ahead to expand within the state. The fact that almost all of these applicant companies have decided to invest in Nevada and participate in its incentives programs points to the confidence in their abilities to staff workers here by tapping into existing local talent, training internally or by attracting talent into the state.

Surprising in these results is the lesser degree of importance rated for the “Availability of Higher Education Resources” factor, which can be considered as part of the workforce equation. The universities and colleges within the Nevada System of Higher Education and their career service offices can provide decision support to companies that are seeking talent at competitive costs. Aside from providing recruitment and hiring assistance, information about the curriculum of the various colleges and its majors and apprenticeship programs can provide layouts of career-based education pathways. Also, companies can better understand local labor conditions by evaluating the number of students graduating, their degrees and certifications, the changes in the retention rates of graduates deciding to remain local, and possibly salary information to assist with developing a market-based compensation structure. Proactively disseminating this information may be helpful in engaging prospective companies.

Ratings by county region

Over three fourths of the companies chose to locate or expand in Nevada’s two urban regions: Clark County and Washoe County, anchored by the cities of Las Vegas and Reno. Companies rated the “Availability of a qualified workforce” as the third largest contributing factor after tax structure and incentives in both the Clark and Washoe counties at 4.26 and 4.21, respectively.

Another highly-rated factor in Clark County is the business permitting and regulatory structure. One of the responses to this need has been to streamline the business licensing process across jurisdictions in Southern Nevada beginning in 2012. The Washoe County region has racked up successes in attracting technology-driven companies into its communities and is highly competitive when it comes to affordability, particularly for those migrating from the neighboring Northern California region. It’s no surprise, then, that “Labor costs” rated high in Washoe County at 3.89.

Storey County is also part of Reno’s metro area, however over half of the land mass there is occupied by the Tahoe Reno Industrial Center (“TRIC”), the largest industrial park in the country. Various tech, manufacturing and distribution companies are attracted to a variety of TRIC’s features, including facilitated permitting processes, utility infrastructures built for high capacity and transcontinental transportation linkages via Interstate 80 and Union Pacific rail lines. For applicants locating in Storey County, responses shows a relatively higher rating for most all site selection factors when compared with other counties. Though the importance of a qualified workforce is considered to be significant (4.00), it is exceeded by the permitting and regulatory structure (4.67), utility structure (4.60) and utility cost (4.20) criteria.

The counties of Lyon, Douglas, Churchill and Pershing border the Reno metro area and are considered rural regions. The incentivized companies were mostly in manufacturing and sought a regulatory-friendly environment (4.43) with access to a qualified workforce (3.86).

Ratings by industry sector

Mentioned previously, “Manufacturing,” “Professional & Business” and “Trade, Transportation & Utilities” dominate the types of core operations that the applicant companies are engaged in. In the manufacturing sector, the availability of a qualified workforce and business permitting and regulatory structure were rated as having a high level of importance at 4.05 and 4.10, respectively. For the professional business service companies, the availability of a qualified workforce was among the highest (4.41), followed by labor costs (4.07) and permitting and regulations (4.04). Interestingly, access to higher education resources were rated higher for this sector than any others. Lastly, workforce mattered notably for the trade, transportation and utility applicants (rated at 4.28) and also focused on real estate costs (4.04), transportation costs (3.96) and the permitting and regulatory structure (4.00).

In sum

Criteria that drive the site and location search varies considerably from company to company, even within the same industry, depending on its specific competitive positioning, supply chain, target market and so on. Within companies themselves, expansion project objectives, specifications and priorities can and do vary from year to year in response to both internal and external changes. The reality is that the task of assessing the potential of a U.S. state or global place and its regions for investment is an increasingly complex one. That said, there are sets of similar needs that are considered to be of higher importance to the selection process. In particular, most companies geared for growth have a vested interest in the workforce and the ability to obtain and retain critical skills at competitive costs. Regions that already have in place a high number of workers with the qualifications relevant to companies are well-positioned to attract those companies early on in the location process.

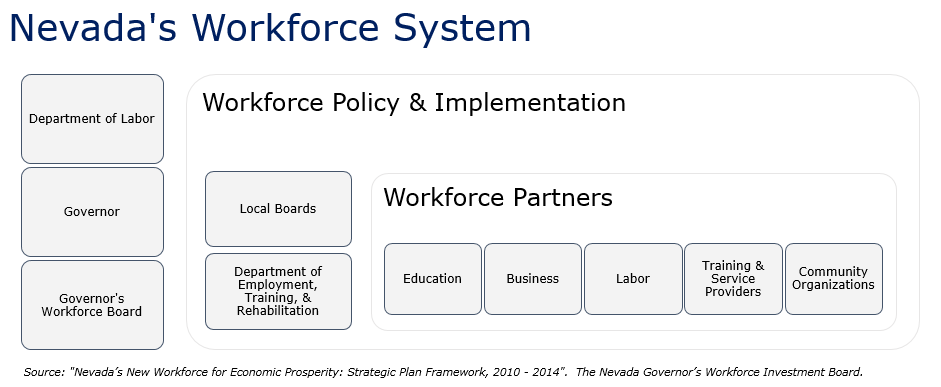

The survey findings from Nevada’s incentivized companies reflect the availability of a qualified workforce as being among the most important factor, regardless of the industry and region within the state. While the state consistently attracts talent into its urban areas for its affordability, job opportunities, natural spaces and various quality of life factors, its workforce has a number of deficiencies that threaten the long-term attainment of its economic development goals. The more apparent ones are the lack of diversity in the job base, underperformance or gaps in K-12 and higher education, college graduate retention and mid to high-level skill gaps. However, the level of collaboration between stakeholders in Nevada’s workforce system are at an all-time high, where state and local organizations, together with its workforce partners in education, private industry and others, have renewed focus in addressing these challenges. A collective focus is to develop and maintain a modern workforce through initiatives that support our key industry sectors by aligning education, job training and workforce development programs in local areas in order to achieve targeted objectives.

When it comes to talent development, the private sector has a vital role in contributing to the creation of a skilled local workforce. Aside from providing ongoing career training, those in private industry truly know how skills are changing in their organizations, placing them in the best position to communicate to other stakeholders on what the evolving skill requirements are. Jobholders themselves are increasingly aware that relying on past experiences, education and training may no longer be sufficient. To remain competitive, it’s necessary to acquire new job skills, both technical and people-oriented, throughout their career in order to meet the demands of the rapidly changing workplace. The willingness of employers and workers to embrace these roles will impact the ability of Nevada’s communities to address some of the most pressing challenges its workforces face. It has yet to be seen whether the more recent workforce initiatives and infrastructure in place for Nevada will develop and evolve in such a way to meet the changing requirements of its workers who are ready, willing and able to fulfill the expectations of the future workforce.

=======

Learning points

Workforce and labor market considerations are vital to companies looking for a location to grow its operations and for regions’ sustainable economic development. This is common knowledge and that should be enough, but again, I’m interested in seeing what the numbers had to say. Aside from satiating my own curiosities, this project is really more about applying R’s regular expressions (regex) capabilities to mine text and my learning how to put together a dashboard in Tableau. After some thought, this was an ideal fit and I knew exactly what I wanted to do (but definitely wasn’t sure if that exact way was possible!).

The first step was to compile the publically available PDF reports that included the applications. Then, come up with a methodological approach based on the patterns in the reports’ layout and on the tools I wanted to use. Spending time upfront to understand intricacies in the reports was crucial to streamlining the rest of the process and reduce trial and errors. I won’t bore you with details, but let me just say this: when taking a stab-in-the dark approach, working with string pattern matching and the very finicky nature of the regex language is not the time to do it. This is where having a regular expression cheat sheet came in very handy. Other learning points along the way:

-

If I ever have to put together an application or form again, I’ll definitely be thinking about the layout structure and format. This makes a huge difference in the ease (or difficulty) of liberating the content through scraping methods.

-

That I should know better than to make simple survey mistakes. For measures of importance on a 5-point scale, the instructions could be written better to reduce ambiguity and validate results. Rather than “1 = very low; 5 = very high”, it should be framed as: “1 = Unimportant, 2 = Somewhat Unimportant, 3 = Neither Important or Unimportant, 4 = Somewhat Important, 5 = Very Important.” The option for “very low” is leading in that it assumes a factor has some importance when it may have no importance at all to the respondent. It’s subtle, but “very low” (i.e., 1) in one survey could read as either being “unimportant” (1) or “somewhat important” (2) in another.

-

How to source files in R, and how it can be used as an external script to run on a current script. The main script contained a for-loop to first convert a PDF file into a text file, then uses a wrapper function to call on the external source script that does the text mining, then return back to the main script to save the mined information from each text file, before finally combining the results into a single data frame. The order of the tasks were important so being able to loop through a sourced script made the code more efficient when going through the iterations for each of the applications.

-

How to put together a dashboard in Tableau 10.5. As expected, its GUI (referring to its Graphical User Interface) is point-and-click heavy. But certainly more flexible than what I’ve done in the past: painstakingly converted Excel charts and tables for use in Illustrator and InDesign. Plus, Tableau is interactive and has this cool dynamic tool-tip feature where you can see information pop up when you hover your mouse over a data mark.

-

I’m reminded that reports were my least favorite part of projects when I worked in consulting. Writing is not my strong point. Can’t say I enjoyed it, but they are useful experiences!

The process for this project was the usual “turn data into information, then information into insights”. Here’s the links to the results, depending on the viewpoint in this multi-step process:

Data source: My GitHub, repo: “stringmatch-siteselect-nv”

Information: My PublicTableau, viz: “Nevada Site Selection Factors Survey”